Table of Contents

What if you were able to set-up your startup without spending any of your own financial resources? And what if you could dedicate your time and resources to focus on your idea without worrying about petty details? With the advancements made in FinTech, your wishes can actually come true!

What is exactly “FinTech” about?

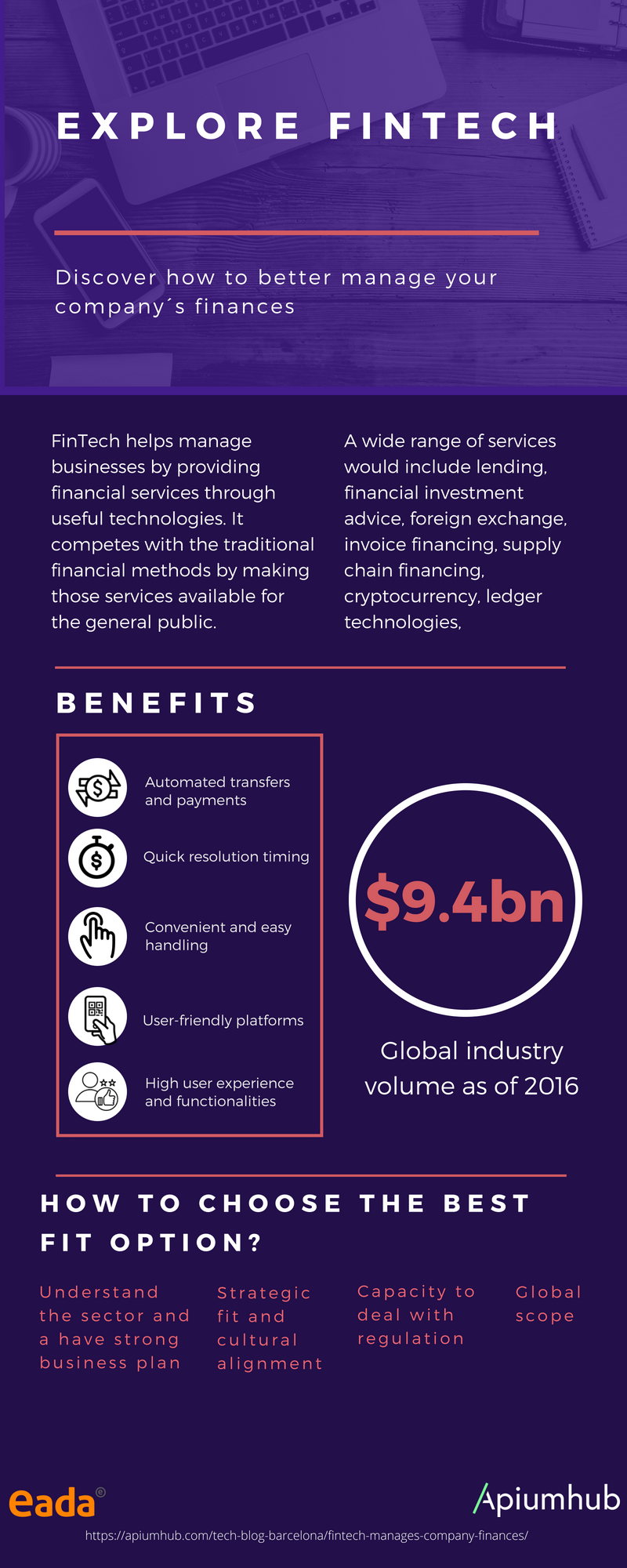

FinTech (or “Financial Technology”) helps manage businesses by providing financial services through useful technologies. It competes with the traditional financial methods by making those services available for the general public, with a global volume of $9.4 Billion as of 2016 (source: BI Intelligence). A wide range of services would include lending, financial investment advice, crowd sourcing, foreign exchange, invoice financing, supply chain financing, cryptocurrency, ledger technologies, etc.

The industry employs complex algorithms that often take the place of traditional advisers, perhaps offering more efficient and personalized products for end users.

Why should you consider working with a FinTech company?

From budgeting tools to alternative lending and investment options, payments processing, cash flow management, and philanthropic platforms, you have a lot to gain from the advent of financial technology startups. (Source: Investopedia). Some of the main advantages include:

- Automated transfers and payments

- Convenient and easy handling

- User-friendly platforms

- Quick resolution timing

- High user experience and functionalities

Some companies in Spain

According to Fintech Global (click here for source), Barcelona is among the top 5 cities with highest investments in Europe. The fact that Barcelona has also become an innovation and start-up hub, has created the perfect ecosystem for FinTech. Fintech Radar Spain (click here for source) actually identifies 294 FinTech startups with Spanish roots and growth rates keep prospects positive. So here are some examples of FinTech start-ups that are disrupting the Spanish market:

Kantox is a multinational company offering FX management solutions to control currency exposure, build hedging strategies, automate FX transactions and process international payments in a smart way. It is the perfect tool to save money and manage better your cash-flows when operating internationally.

Startupxlpore is the largest startups and investors community in Spain. Here you will find a safe site to run your crowdfunding investment rounds in a simpler way. Lots of venture capital funds and business angels are willing to raise your capital in Startupxplore.

Founded in 2014, NoviCap is currently disrupting the invoice finance industry by providing an online software to process your invoices easily, faster and in a transparent way. NoviCap will allow your business not only to manage better your cash-flows but also to reduce all the inefficiencies of traditional corporate lending.

Founded in 2015, Finizens is an automated investment management company that uses technology to optimize your investment portfolio. Diversifying your risks and investing your money in more than one venture is one of the key principles of management. Keep an eye on Finizens, it can be useful tool to do so.

5. Corefy:

Corefy, founded in 2018, is a service of integrated payment solutions for all areas of business. The application allows you to connect to hundreds of payment systems in one place and get full control over your transactions. A user-friendly interface that allows centralized, standardized simplification of accepting online payments.”

How to choose the best fit option?

Since the FinTech revolution arrived and throughout the past years, there are a lot of companies and startups that create new solutions every single day. However how do you choose which one best suits your needs? Here there are some criteria to choose that one that will be the best for you.

Strategic fit and cultural alignment:

It is important to study all the options and analyze which will fit better for your strategic plan. You would have to establish a good relationship with their management team and board of directors and see how your teams can fit together. You are essentially looking at your allies that you aim to grow with, therefore you must align and share the same ambitions, visions, and goals.

Understand the context and a have strong business plan:

The FinTech company has to have the ability to understand the overall and specific context and the expertise of the industry, in order to create integrated solutions that can also be adapted to your business with a focus on what’s coming next.

Capacity to deal with regulation:

Knowing that regulations are key in this sector, the board of directors and the founders have to be willing and become comfortable dealing with legal details and make sure to assess the local guidelines and agreements from the very beginning.

(Sources: Techburst, BankDirector)

Global scope:

Better choose a FinTech company that has a global focus to create solutions that can be universally used or can be more likely to adapt to a new market.

It is up to you:

Now that you know who and what to look for, we hope we have helped you make your decision and take charge of your own business. There are no more excuses to wait forever for traditional financing, it is time to focus on what you do best and move the world forward!

And here you have an infographic with hihglights for the article:

If you have a FinTech project and you need software development help, contact Apiumhub!

About the Authors

Lizet Llanos Montalvo, Lea Faure, Karine Mendelek and Alex Navarro Gómez are marketing students in EADA Business School with a passion for new technology.

If you found this article about FinTech interesting, you might like…

- Top business blogs to read

- Leading innovation hubs

- Human-centered innovation

- Top smart city projects to watch

- Blockchain technology: use cases, statistics, benefits, startups & events

- Barcelona; one of the best smart cities in Europe

- Disruptive innovation to track

- The era of unicorns

- Top 20 promising startups in Barcelona