Table of Contents

Fintech startups & companies just continue to be a hot trend in the world of entrepreneurship, innovations and investments. The trend has been moving banks and other financial institutions move to collaborate more with their disruptors. Fintech segment can cover almost everything, from payment systems & applications to digital investment managers and insurance. So let’s take a look at the fintech sector and its main players in 2017.

Statistics, facts & predictions about Fintech startups & companies

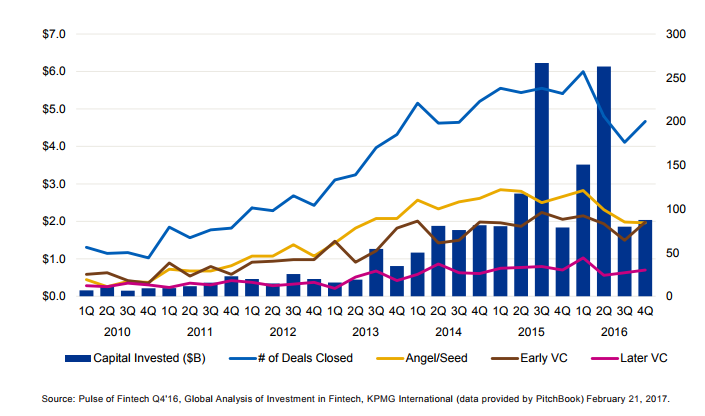

The global analysis of Fintech Q4 2016 made by KMPG states many noticeable facts.

Here are few of them I would like to list down.

- In 2016, global investment in fintech startups & companies hit 24.7B across 1076 deals.

- However, total fintech funding declined almost 50 percent, falling to $25 billion from the $47 billion invested in 2015. It can be caused as the investment industry is directly connected with the political, economical issues as well as with many other local and global factors.

- Insurtech (insurance companies) interest grows exponentially as the industry starts to play catch up. Heading into 2017, interest in insurtech is expected to remain hot across all regions of the world. Most insurtech investments will likely focus on companies specializing in individual components of the insurance value chain (e.g. distribution, underwriting, claims, customer service).

- Blockchain reaching a tipping point.

- Governments are recognizing the value of fintech innovation.

Global venture investment in fintech companies 2010 — 2016

Source: KMPG

10 Fintech startups to keep an eye on

1.Metromile

Metromile is the first on on our list of top fintech startups. It is an insurtech startup for those who own a vehicle, but let’s say don’t drive that much. Metromile can be the right option for you, instead of paying monthly or even yearly fees, Metromile will charge a fee per mile to insure your vehicle. During six rounds, startups already received more than $200 million, mainly from China Pacific Insurance, Acequia Capital and Index Ventures. In 2017 Metromile got an award as one of the five startups to watch in 2017 by Fast Company, being named as a completely new insurance model.

2.WiseBanyan

Being founded in 2013, WiseBanyan is an online invesment management startup that will help you to create an investment portfolio for only $1. It’s a great idea for those who’re searching for a small investment ways. might be a good fit if you’re searching for a small investment idea. WiseBanyan’s app offers sophisticated computerized algorithms and consumer-friendly dashboard analytics. In June 2016, the company received an undisclosed amount of funding in two rounds from seven investors after its initial funding round in September 2014. As of February 2017, the company has 20,000 active customers and manages $80 million, according to its cofounder Vicki Zhou.

3.TransferWise

As globalization continues, the demand for international money transfers is expected to expand. Transferwise offers a transparent money transfer system that enables individuals and businesses to send money abroad without hidden fees and offers fair exchange rates and low transfer charges.

In May 2016, the London-based company received its most recent Series D funding round of $26 million. The latest round capped its six funding rounds totaling $116.37 million from big-name investors including Andreessen Horowitz, Valar Ventures, Seedcamp and IA Ventures.

4.Stash

Stash, launched in October 2015, offers DIY investing tools and tips for people to build their own investment portfolios. If you don’t want to use preset, robo-advisor software for investing, Stash might fit the bill. You can choose from tech, healthcare, environmental, social network and globetrotter portfolios.

Stash received four rounds of funding totaling $38.75 million. Its well-known funding companies include Valar Ventures, Goodwater, Breyer and Entree Capital. In the crowded fintech investing arena — populated by Grow, Acorns, Motif, WiseBanyan and other new companies — Stash is turning heads.

5.Square

The Square point-of-sale app enables businesses to accept payments, track sales, manage inventory and more. If you’ve shopped in a mom-and-pop store, you might have paid your bill using the ubiquitous white square device.

Jack Dorsey founded the San Francisco startup, which went public on Nov. 19, 2016. The company received $590.5 million in seven funding rounds before it went public and has completed 11 acquisitions in the past five years.

The Square retail app, launched on Feb. 8, 2017, underscores the innovativeness of this startup — it provides a full retail solution that includes inventory and retail management tools.

6.Compass

Compass is slowly entering the competitive real estate market — its technology-driven real estate portal competes with Trulia, Zillow, Redfin and RadPad to help consumers and realtors navigate the complex world of buying, selling and renting real estate. Compass, which is currently available in nine locations, will find a qualified agent for you or help you find an apartment or home.

Founded in 2012, the company received five funding rounds between 2012 and 2016 totaling $208 million. Recognizable investors include Goldman Sachs, Marc Benioff, Kenneth Chenault and Wellington Capital.

Compass’ marriage of top-level agents and proprietary technology sets it apart from the pack. Its access to large amounts of capital and disciplined entrance into the new market is proof of fintech’s potential.

7.Future Finance

Hailing from Dublin, Future Finance is a specialist loan provider targeting students. Earlier this year, CEO Brian Norton said that almost 40,000 students had sought loans through its service since it began in 2014. Business is largely UK-based for now, but plans are to gain traction in Ireland, Germany and the rest of Europe in time.

Future Finance’s decisions are entirely data-driven, using algorithms built from scratch in Dublin. This year, the young company has been raising funds to the tune of €150m and creating jobs in its hometown.

8.Aztec Exchange

Aztec Exchange has had an exciting year, culminating with a spot on Forbes’ Fintech 50 list alongside Stripe – the daddy of all Irish-founded fintechs.

Founded in 2012, this Dublin-based service supports businesses around the world, offering low-cost invoice discounting for suppliers and supply chains of major corporations.

The company reportedly raised €3.5m in funding earlier this year, before launching a new e-invoice finance solution, PayMe, in May. Using PayMe, registered suppliers can sell their invoices online and receive the working capital they need within days, while Aztec Exchange receives a fee for each successful transaction.

9.Deposify

Yet another Dublin fintech, Deposify lets landlords and tenants manage and control how and when deposits are paid.

At just two years old, the start-up founded by Jon Bayle has been recognised as a disruptive force in the rental market and has received the backing of the Union of Students in Ireland.

After raising €1.1m for a US expansion, Deposify selected Boston as the location of its new HQ, with plans for more offices in New York and other urban markets.

10.SumUp

Founded in 2012, SumUp provides small firms with mobile point-of-sale services via Apple iPhone, iPad, iPod Touch and Android smartphones.

Earlier this year, it merged with leading mobile card payments company Payleven, joining forces in April to become the global leader in mobile payments.

As of September, SumUp became the first mobile payment company to hit profitability, having doubled its revenues in the last six months, and is currently approaching $100m in annual revenue.

11. Aid:Tech

Just two years old, Irish start-up Aid:Tech is making aid entirely transparent using blockchain technology.

CEO Joseph Thompson cites that $1.1trn of essential aid is lost through global corruption, while 30pc of the $161bn donated by OECD countries each year simply ‘disappears’. To counter this, Aid:Tech uses an intelligent voucher system with unique IDs for refugees to receive aid.

A London Techstars accelerator alum, Aid:Tech has secured deals with the UN, the Red Cross and Concern. Future plans for this technology could see the company take on social welfare payments in the form of remittance.

Are there any Spanish Fintech Startups?

Kantox

One of the known company not only in Spain, but in the world – Kantox. It is a foreign exchange service provider, offering SMEs and mid-cap companies a comprehensive solution to their foreign exchange needs, based on transparency, efficiency and value. Their transactions reached $1 billion, broke the $3 billion barrier in April 2016. It completed an $11 million funding round from Partech Venture, IDinvest Partner and Cabiedes & Partners in May2015, and released new software this year which automates FX transactions and payments.

peerTransfer

peerTransfer is an international student payment solution that allows foreign exchanged students to pay for their tuition, housing and other services using their home currencies, avoiding the high fees and commissions from banks.

Coinffeine

Coinffeine is an open source, peer-to-peer (P2P) bitcoin exchange platform. You can easily buy and sell bitcoins securely and anonymously without having to rely on a centralized exchange.

If you liked this article about fintech startups interesting, you might like…

Digital Identity trends & startups to watch

Blockchain technology: use cases statistics, benefits, startups & events

The latest trends in the technology industry

A list of 20 most active venture investors in Spain

Author

More to Explore